-

我厂被授予中国商标,让消费者满意示范单位等多个荣誉称号。

-

u球体育等产品均采用原料按相关标准设计、生产,经检验机构检测其性能均达到标准要求。

-

u球体育为自主生产型厂家。每年约有3-4种新产品问世。带有努力开发,不断创新的总思路赢得了河北u球体育市场。

-

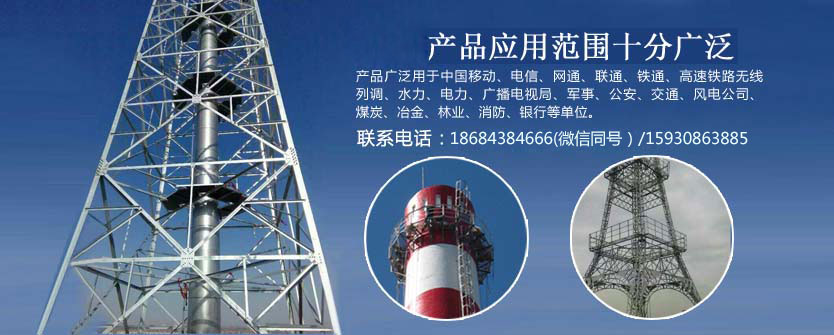

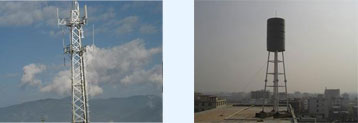

我厂主要经营u球体育、监控塔、通信塔、工艺塔、瞭望塔、测风塔、增高架,加工各式u球体育,并可按客户要求定做!

u球体育是一家致力于u球体育、测风塔、装饰塔、工艺u球体育、楼顶u球体育、避雷针塔、避雷线塔、装饰塔、测风塔、监测塔、组合塔、瞭望塔、移动通信塔、标志杆等钢塔桅杆及各种钢结构生产、安装的厂家。座落于中国铁塔之乡、儒家董子故里广川镇。公司重视人才,注重员工的定期培训,以提高员工的整体素质。能够完成产品在各个生产环节的检验,使产品从原材料进厂到产品出厂的每个环节,都能控制。欢迎新老客户致电咨询,韩经理:18684384666。

- 07.12什么是gjtu球体育

- 07.11u球体育安装技术交底

- 07.10ghu球体育哪里的好

- 07.09哪里有gfw系列钢结构避雷线塔

- 07.08gfw避雷拉线塔怎么选购

- 07.06gflu球体育基础图怎么看

- 07.05GFL2 14 u球体育图纸如何设计

- 07.04ff10-2调整u球体育是什么

-

u球体育

联系人:韩经理

手 机:18684384666(微信同号)/15930863885

手 机:15930863885

河北省衡水市景县广川工业区

网址:www.suliaomojujiagong.com